Just as few foresaw the long bull market, few anticipated the recent

downturn. Sure, there are people who have predicted 17 of the last three

sell-offs, and who will claim to have called this one, too. Nope.

Huddling in a tent for several years straight, then leaping up to

exclaim "Aha!" when the thunder finally sounds, does not a rain doctor

make.

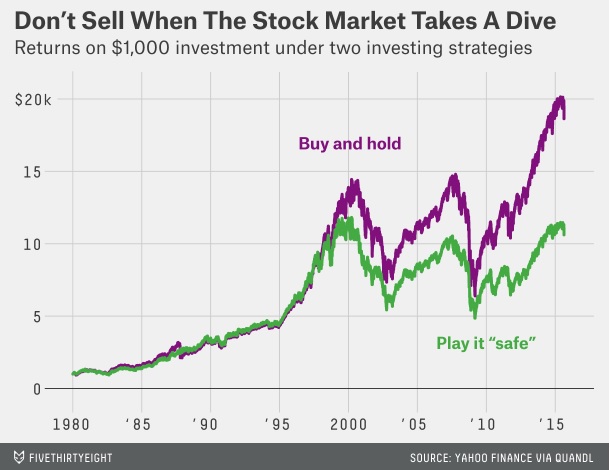

This collective fog makes post-crash interviews excruciatingly dull. Stay the course. Hold tight. Don't give in to your emotions. The

bromides are mind-numbing. But they are correct, in that it is no

easier to predict the market's recovery than it is its decline. This

chart from FiveThirtyEight

shows the results for a theoretical investor who moved to cash whenever

stocks fell by at least 5%, then got back in once they recovered by at

least 3%. Not pretty.

So one would think the inverse would be true. Buy when stocks fall by 5% (to simplify it.)

No comments:

Post a Comment