- Expect short-term stock market volatility as the election heats up. But longer term, economic fundamentals are likely more important drivers for stocks than who wins the White House.

- A Biden presidency could mean more economic stimulus than a Trump second term, but also higher taxes on businesses, higher income people, and capital gains.

- While President Trump has focused on deregulation, a Biden administration would likely re-regulate certain industries. Among the possible targets: Fossil fuels, financial services, health care, and big tech.

- Stock buybacks have been a significant source of returns for stock investors over the past decade. Democrats could move to limit them, while Republicans would likely support the status quo.

Elections matter to all of us, as citizens and as investors. US presidential election results drive policies that help shape our economy, the markets, and our lives. So it’s important to think about what the outcome could mean to your wallet.

And it's not just the presidential election that matters. Since much of a president's agenda requires congressional approval, the outcome of the congressional races is also key. Indeed, this time around, control of the Senate may be the key to enacting the next president's agenda.

The political outlook

At this early stage in the 2020 campaign, there is plenty of time for surprises to alter the course of history—particularly given the fact that this election is taking place in the midst of a global pandemic that has hit America hard. Still, it's worth considering a range of possible election outcomes. Here we look at 3 of the most likely scenarios—and the potential financial implications of each.

President Trump wins a second term and Congress remains split between a Democratic House and a Republican Senate

The Democrats sweep the White House and Congress

Former Vice President Joe Biden wins the presidency, but the Republicans hold the Senate

Scenario 1 is a continuation of the status quo. Scenario 2 likely brings re-regulation of some industries, higher taxes on corporations, upper-income individuals, and investors and more fiscal stimulus than in Scenario 1. In scenario 3, changes to tax and spending policy are likely muted by a GOP Senate.

Let's dig into some details.

The economy

No matter who is elected next year, the economy will likely still be recovering from recession and hardly at full throttle. So fiscal policy—federal taxes and spending—is likely to be key to economic growth.

"The 2020 multi-trillion-dollar fiscal spending package has been a major factor that's kept this economic environment from getting worse, along with the Fed's monetary stimulus," says Dirk Hofschire, Fidelity senior vice president of asset allocation. "But there is a risk, as we go forward, if the economy is not gaining significant traction and you still have large parts of the economy operating at limited capacity, that we're still going to need a lot of fiscal support."

Biden has proposed a combination of more federal spending and a redistribution of the tax burden from middle income taxpayers to corporations, high-income taxpayers, and investors. Hofschire says that's likely to mean more short-term fiscal stimulus under a Democratic presidency than a Republican one, particularly in a Democratic sweep.

"The tone of the Democratic fiscal plan would also be more likely to try to address growing income inequality and provide more spending and/or tax breaks geared to lower- and middle-income households," says Hofschire. "Because lower-income households tend to spend most of their income gains, this might be helpful consumer stimulus if the economic recovery is still struggling to regain traction."

But Hofschire speculates that a Biden tax plan, all other things being equal, would probably be "somewhat worse for the corporate profit outlook" than a Trump second term, and could fuel inflation longer term.

Taxes

During the Trump administration, federal tax rates on corporate and individual income and capital gains came down dramatically. The president has spoken of further cuts in a second term, but with a Democratic House that could be difficult to achieve. A more likely scenario is a continuation of current tax rates.

By contrast, Biden has proposed increasing the top tax rate for corporations to 28% from 21%, and for individuals to 39.6% from 37% while treating capital gains and dividends, now taxed at a top rate of 20%, as ordinary income.

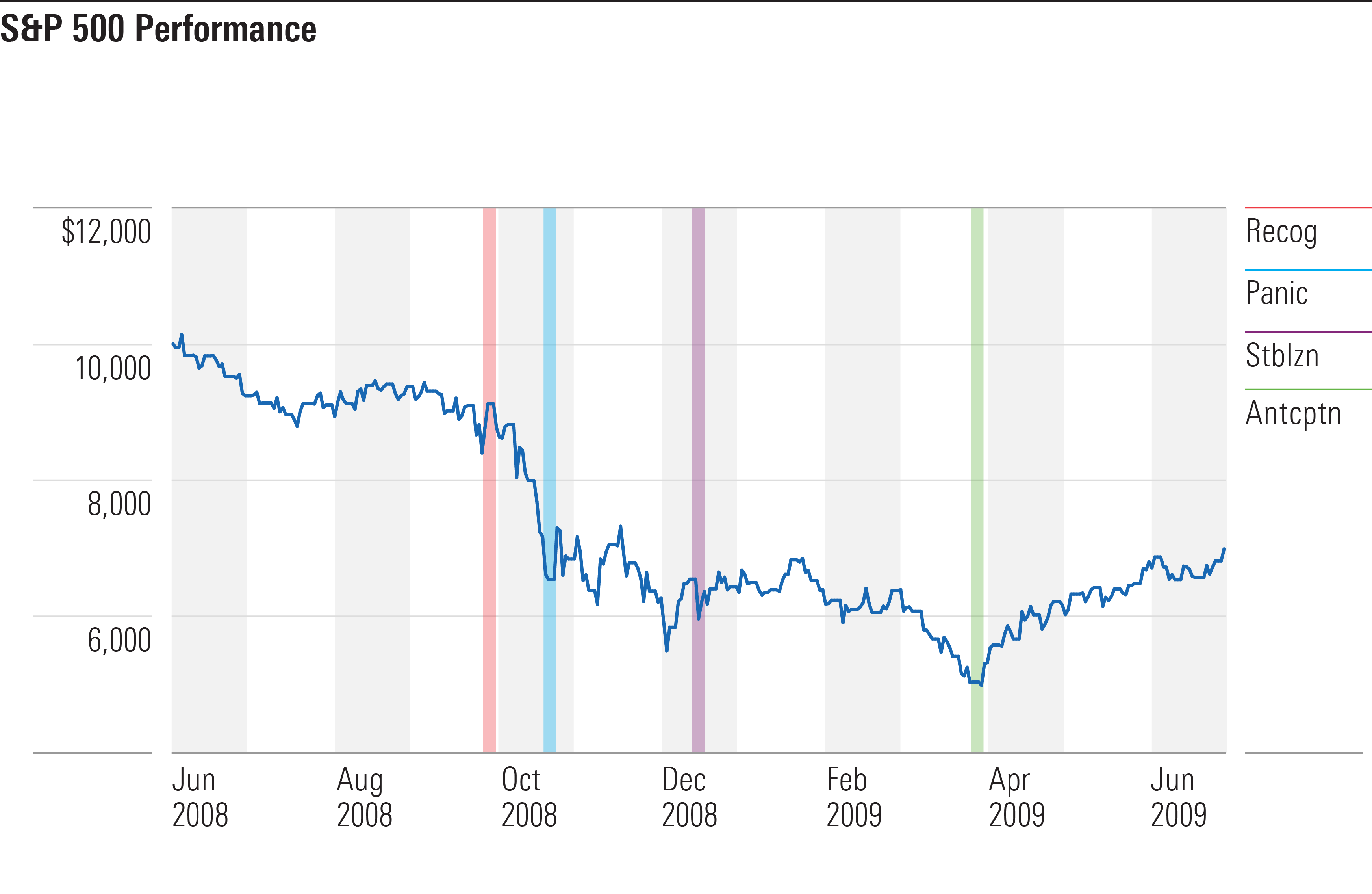

Increases in corporate tax rates would be a hit to earnings, which are one driver of stock prices (though not the only one). But historically, rising corporate and individual tax rates have not meant falling stock prices, Fidelity sector strategist and market historian Denise Chisholm notes. In the 13 previous instances of tax increases since 1950, the S&P 500, the stock index that tracks most of the major companies in the US, has shown higher average returns, and higher odds of an advance, in times when taxes are increasing, according to Chisholm's research.*

This holds true even when you drill down into key sectors of the S&P 500. "Economically sensitive sectors, like consumer discretionary, oddly have done better on average during years taxes increase. These counterintuitive odds suggest something else is going on—the market either discounts it in advance or the economy has received stimulus to offset it," says Chisholm.

Of course, if you are facing rising individual rates, you will want to consider strategies to minimize the impact on your bottom line. In addition to higher federal tax rates on income and investment gains, Fidelity's head of government relations and public policy Jim Febeo notes that the Biden campaign has talked about rethinking retirement savings tax incentives to promote more equality among different income levels. That could include reduction in the tax deduction for IRAs and 401(k)s, at least for upper-income people.

"With the fiscal situation where it is, all sources of potential revenue could be on the table," says Febeo.

It's always a good idea to take advantage of tax-preferred retirement savings opportunities, but that may be particularly true this year, given the potential focus on tax increases under a Democratic regime. Other strategies to consider if you are concerned about tax rates rising: taking some capital gains, or converting a portion of your traditional 401(k) or IRA savings to a Roth.

Stocks

For the overall stock market, there are pluses and minuses under all 3 election scenarios. With Biden, you'd likely have more fiscal stimulus but higher taxes on corporations and higher earners. That could include higher taxes on capital gains and disincentives for share buybacks, which have helped drive stock valuations higher in the US than other countries. With Trump, you'd likely see lower taxes but less stimulus and a more confrontational approach to US-China relations, which has unsettled markets in the past.

That makes it difficult to say which administration would be better for stocks. Says Jurrien Timmer, Fidelity's director of global macro: "It's my personal sense that the 2020 election will have less impact on the markets than some suggest. Ultimately, it's the long wave of economic fundamentals that drives the markets beyond any one election or any one party."

Still, in the near term, there would likely be different winners and losers under a Republican versus a Democratic regime, due to very different regulatory approaches.

The Trump administration ushered in a period of deregulation. One major winner was the oil and gas industry, which benefited from less stringent environmental regulations. "The Biden administration would likely go in the exact opposite direction, rolling many of those executive orders back and pushing for more clean energy," says Hofschire.

Other sectors that could come under heightened scrutiny in a Democratic administration include health care, financial services, and big tech. Says Timmer: "The 5 FANG stocks (Facebook, Amazon, Apple, Netflix, and Google) are 20% of the US stock market and are actually pulling the market higher right now. If they stop pulling, the market may stop going up, so that's yet another dimension to the puzzle."

Trade

On the trade front, the differences between the candidates may be more stylistic than substantive. "The tactics and tone of the US-China relationship might change," says Hofschire.

"Trump often takes a confrontational tone on social media. Biden is probably a much more conventional politician in regard to trade and foreign policy and would be more likely to build multilateral coalitions to try to influence China. However, there is a broad, bipartisan consensus to get tough on China, so any future policies are likely to continue to ramp up export controls, restrictions on investment, and other decoupling activities that deepen deglobalization pressures," Hofschire says. Among them: Incentives to bring back key links in the industrial supply chain to the US or at least diversify out of China.

Interest rates

Regardless of the election, interest rates are likely to stay low for a long time—so it's a good time for borrowers. Says Beau Coash, institutional portfolio manager in the fixed income division: "Given that the Fed is going to keep buying and supporting the bond market, it's hard to see interest rates going up anytime soon—probably not before we get back to a fully open economy."

If you are considering buying a home or refinancing, now is a great time to comparison shop. If you have a large portion of your portfolio in cash or low-yielding bonds, it might be a good time to meet with an advisor to discuss a long-term investment strategy with a combination of stocks for growth potential and high-quality bonds for wealth preservation.

Health care

Trump is opposed to the Affordable Care Act, the health care system put in place under the Obama administration. The Trump administration has brought a lawsuit against it all the way to the Supreme Court. Meanwhile, Biden has talked about enhancing the Affordable Care Act. So far, however, the details of their future plans are faint. So, we will need to wait and see how those plans take shape.

Biden has also spoken about extending Medicare eligibility to unemployed people 60 and over. If enacted, this may offer an interesting opportunity for people considering early retirement—or forced into it. Since health care costs are often a key reason people can't afford to retire early, Medicare could help solve that problem, and potentially enable people to postpone Social Security to their full retirement age or later, capturing higher monthly benefits.

What's ahead?

Given the pandemic, passions surrounding this election, and uncertainty about how and when the election results may be resolved, it would not be surprising if markets got volatile.

"There's a reasonable probability that we won't know the outcome of the election for at least a few days and maybe a few weeks after the election," says Hofschire. "The pandemic is creating huge logistical challenges for the electoral process, making in-person voting more difficult and causing delays in counting due to the high volume of mail-in ballots. Unfortunately, the highly polarized partisan atmosphere isn't making this situation any better. The futures markets are pricing in rising stock-market volatility moving into the elections, and I expect a messy or prolonged aftermath could extend that volatility into December and maybe even January."

*** [posted 8/30/20] ***

On the income tax side, Biden calls for raising the top individual income tax rate to 39.6% from 37%, and applying it to taxpayers with taxable income over $400,000, according to an analysis from the Tax Policy Center.

He’s also talking about an increase to payroll taxes. Biden would apply the 12.4% portion of the Social Security tax — which is normally shared by both the employee and employer — to earnings over $400,000, the Tax Policy Center found.

Currently, the Social Security tax is subject to a wage cap of $137,700 and is adjusted annually.

Finally, Biden would also boost rates on long-term capital gains and qualified dividends to 39.6% — the same top rate as ordinary income — for those with income over $1 million, according to theTax Foundation.

Currently, the long-term capital gains tax rate is 20% for single households with more than $441,451 in taxable income ($496,601 for married-filing-jointly) in 2020.